|

WWW.BOTDORFRESEARCH.COM June 1st, 2024 The State of State 2024 Mid-Year US Economic Report-Update. There is not much that is more challenging than trying to calculate (some economist refer to this as guessing ) where the US and global economies are headed twelve months into the future. For starters where does one begin? We put out our US Economic Reports around December 20th of each year for the succeeding year. We do not touch or change it after it goes out. We live or die on our forecasts and predictions we make in December until the next year’s December report gets released. We often go against the masses in our reports. For example when the financial media and Wall Street were hell bent on “six or seven rate cuts for 2024”, we predicted in 2023 either “no rate cuts at all or one to two small cuts at the end of 2024”. Our deep dive on several leading indicators did not support the common thesis of any real rate cuts for 2024 at the time we released our report in December of 2023. Our research just did not conclude that the Federal Reserve would be in position to cut rates this year. We felt the stock market would see 4-6% gains for the 2024 year, that Iran would see bombing within their borders in 2024, and personal and business bankruptcies, consumer debt, student loans and mortgage defaults would increase substantially in 2024. We also felt that housing prices for median home prices nationally would continue to fall as they did in 2023. It is why we felt US bonds may outperform equities because there is much less downside risk with the same return. Bingo on these so far in 2024. According to the New York Federal Reserve as of Q1, 2024, Household Debt is now at record levels surpassing 2023, now sitting at $17.69 Trillion, up $184 Billion in just Q1. Student loan debt now exceeds $1.7T and is fast becoming the second biggest debt behind a mortgage for many of the 40M people in the United States that have student loan debt. Student loan defaults are rising under this burden as home ownership cost, food, gas, utilities, and insurance cost continue to increase at rates much higher than the reported CPI increases. We also predicted that any one of three isolated events could happen in 2024 with a 67% chance that any one of these three events may occur in 2024 resulting in a severe backlash to the US Economy. We predicted the two wars could merge into WWIII, now involving over fifty countries directly and/or indirectly. By some account we are already there given over 650,000 lives have been lost, and $184B was spent up through 2023 with another $100B being committed. We also noted that China may provoke a war with Taiwan, something that is now on the verge of exploding after what happened over the Memorial Day weekend with China encircling the island with thirty-nine warships and 1,100 war planes on exercise. Taiwan was forced to meet this threat by sending its own planes into the air to protect their sovereign air space. Finally we suggested we could see some large regional bank failures in 2024 as billions in CRE loans face severe mark downs to market. Despite U.S. regulators increasing stress test analysis and reporting requirements, at some point a leaking dam has to break. Lastly, we are set up for some type of terrorist attack on US soil in the next 18 months and are now sitting at the highest threat level in decades. It will take years and a new border policy to begin to reduce this threat level. It is the number one threat facing the CIA and FBI today other than a nuclear attack from outside the U.S. Any one of these events will rock the stock and bond 2024 US ECONOMIC REPORT-MIDYEAR UPDATE WWW.BOTDORFRESEARCH.COM markets and trigger a massive sell off in the markets like what happen in 2023 when Silicon Valley Bank went down in less than a week after the first reports came out. The average P/E ratio at twenty-three times plus is too high compared to our current U.S. GDP growth and coupled with the current cost of capital and the above risk factors, has set the markets up for the highest downside risk profile we have seen since world war II and the 2008 credit meltdown. The underlying factors leading up to these predictions are now well underway. It took us fifty-six pages to cover these and other issues in our 2024 US Economic Report released last December. We also predicted the biggest issue in the 2024 election will be fighting over potential voter fraud particularly in six swing states from ineligible, deceased and non-existent voters. The biggest target state for both sides could well turn out to be Pennsylvania. More likely than not the road to the white house will be determined by who wins PA. Our thesis on the other five swing states has also not changed, although we do have some new predictions in this midyear update on what may happen before the November election. The “Debates” to the extent they actually occur, will impact less than 8% of all voters at this point, with a 60/40 split when it is all over, falling to one side or the other, depending on the state. While small, this group could decide the election. This is why this year we put out a small separate midyear update. As a matter of policy, all of our other research reports on a wide array of subjects are always free on our web site (www.botdorfresearch.com) except for the most current US Economic Report which becomes free in December of each year and is replaced by the new year report. We also leave the former reports on the website because they contain valuable research on numerous topics like why we predicted billions will be lost on Electric Vehicles for years and why they do not reduce carbon emissions after production pollution is factored in. We also reported that the temporary uptick in housing prices in 2024 in many markets is a head fake, and why the total decline in overall housing prices will fall 20% to 30% from 2023 through 2026. Last year the National Association of Realtors reported an overall decline in all four quadrants of the United States came in at 15.9%. We predicted this number would come in at 15%. The reason housing prices remain high in tight markets is because many sellers cannot afford to sell; cash out and then buy another home anywhere near like the one they had. This pricing disconnect is due to mortgage rates being up to 200% higher than two years ago which is now keeping home prices artificially high. Cash buyers are immune to the current interest rate environment with most luxury buyers now paying all cash in high end markets. For the rest of the housing market super inflation in mortgage rates, insurance policies, local taxes, maintenance costs and utilities is keeping buyers out of the market, keeping home inventories at lower levels. This is about to change over the next 18 months as many sellers will be forced to sell due to divorces, job losses and job transfers and the need to raise cash. Also Baby boomers are retiring at the rate of over 300,000 persons per month which eventually has to drive nest egg sellers into the market. This disequilibrium is causing many to confuse the housing market as healthy. The market is never healthy when the vast majority of home owners and move up buyers cannot afford to buy the home they live in. We note the latest figures from the National Association of Home Builders. Traditionally new home prices falling comes before severe market declines. 2024 US ECONOMIC REPORT-MIDYEAR UPDATE WWW.BOTDORFRESEARCH.COM -The median sales price for new homes was $431k in March of 2024. That is down from the record high of $497k in October 2022. This is also in line with our 20% to 30% estimated drop in home prices from 2023 into 2026. -Builder confidence declined this month for the first time since November 2023. Previously, for April, the National Association of Home Builders reported that 22% of builders cut home prices last month. The average price reduction was 6%. The use of sales incentives edged down slightly from March. We note this home price decrease is just for the month of April and represents just one month of price adjustments that will continue well past the election given the current interest rate environment. This fall out is now beginning to hit local markets selling existing homes. There is one formula that is working very well, however. Sell your home, take the money, pay cash for your next home, and move into a tax free state. We called this trend over two years ago and we are now seeing the biggest influx of home buyers in over thirty years into tax free states. It is going to take the Governors initiating and driving legislation in these high tax states by having the guts to lower taxes, provide business incentives, and getting their deficit spending under control to reverse this trend that is likely to continue for years to come. Each Governor of high tax states has little incentive to make the hard choices in favor of kicking the can down the road for the next Governor to deal with. This playbook has been in use for decades and is why states like California that had net inbound migration for over one hundred years are now seeing net outbound migration for the third year in a row. This net outbound migration is resulting is a spiraling deficit for California now approaching over $68B for this year. Money goes where it is best treated- and eventually so do many people who work hard for their money. Our predictions have become even bolder as we reach the midpoint of 2024. We caution our readers that given our current forecast and despite our great track record over the past three years, we are due for being wrong at some point. That does not stop us from making unpopular predictions when the data are pointing toward increased risk in many economic and geo political environments. We tend to conduct intensive research to reach our conclusions and we like to have as many relevant data points as possible to support our positions. This practice will remain in force even if it means we are going against the popular media opinion of the day, something our research continues to opine on. Our 2024 US Economic Report was our longest ever-at 56 pages. Our calculations were more complicated because of two major wars that remain on going in Ukraine and in Gaza including the surrounding proxies involved adjacent or near the Israeli borders. One might ask, what does the Ukraine War have to do with the US Economy? Well, for one, Ukraine was the second largest producer of grain in the world (behind the U.S.) so the war has impacted the cost of cereal and all grain products, like bread. Secondly, the US budget must be revamped to accommodate war spending by the U.S. to support the war. This only increases the deficit which through a series of events we explained in our 2022 and 2023 reports, just increases inflation. It is why the days of 2% inflation are over for a long while. 2024 US ECONOMIC REPORT-MIDYEAR UPDATE WWW.BOTDORFRESEARCH.COM These two wars are also affecting the overall cost of capital for all nations, driving up global inflation, creating shortages, and creating the need to increase defense spending around the globe. This is taking funds away from social programs, spending for infrastructure programs, and is now slowing down GDP growth on a global basis, thereby producing a negative trend in Money Velocities on all continents. Money Velocity is how many times a unit of currency turns over in a year for a given country, so the higher the MV the higher the GDP and vice versa. In short these wars besides costing several hundred billion so far are taking precious lives and show no signs of easing up this year. The latest figures are approaching 600,000 lives lost on the Russian side of the war. Ukraine has fared much better with just under 40,000 lives lost. This is due to the clever use of attack drones and western weapons that fly smarter and can react very quickly to troop maneuvers. These weapons in many cases are smarter and off the radar of most Russian defensive capabilities. Russia is trading lives for weapons in this war, now losing around a thousand troops a day, a number that is not sustainable. We note the math on what these wars cost just through 2023 below. With over seventy countries on the IMF “Watch List” for danger of defaulting before the wars even broke out, we now have one third of all countries well overextended on debt and even large, industrialized countries like the United States, are going to feel the pain of this war debt. We covered these alarming debt to GDP ratio’s and how they will slow global growth in detail in our 2022 and 2023 reports any why they will prove to be problematic and inflationary going forward as these defaults increase. As noted below, as of the end of 2023, over $184B has been pumped into the two wars and this does not include the increased military spending many Nordic and European countries are pouring into their military budgets. This of course excludes the latest $61B package the United States just committed in April of 2024. These wars are also causing havoc in the China Strait, where China, the Philippine’s, Australia, and Japan are vastly increasing their defense spending as a by-product of the Ukraine and Israeli wars. Before 2024 is over, we estimate that over One Trillion dollars will be redirected into weapons and increased military armies as a result of these wars from over fifty countries, and now, an extremely dangerous environment in the China Strait. China realized over ten years ago they did not have the logistical assets to mount an attack on Taiwan. They started on a dedicated program to develop, build, and convert what is now over 300,000 cargo, civilian and military ships, and boats to manage this task. They also build several islands within military reach of Taiwan “to be ready” when this day comes. Special training, newer military planes and contingency and logistical support are now in place. When President Putin recently met with President XI of China about a month ago, they had something in mind for the US to be released on Memorial Day. On Saturday, May 25th, Ukraine saw one of its heaviest days of fighting and bombing while China entered into war games by surrounding and in some cases blockading access into and out of some portions of the China Strait. This has now caused the U.S. to send in the President Reagan Super Carrier, the most powerful Military Carrier in the world. She does not come alone. A considerable number of anti- 2024 US ECONOMIC REPORT-MIDYEAR UPDATE WWW.BOTDORFRESEARCH.COM submarine, attack frigates, logistical, and attack craft are part of what comes with this super carrier. The U.S. is now in communication with the Netherlands, Japan, South Korea, Vietnam, and the British to monitor the China Strait around Taiwan. The “Island Chain Strategy” once employed by the United States seventy years ago, is now top of mind for the overall strategy to defend the China Strait and protect the sea lanes that serve one third of the world. Tensions are now the highest they have been in decades, and the probability of a mistake or false interpretation is about as high as it can get without being in a formal war. As a result the U.S. will soon see its first One Trillion dollar military budget by the end of 2025. again pulling money away from medical, social and infrastructure programs, also seeing pressure to cut social benefits sooner than later. While this is great for the Industrial Military complex and the defense contractors that feed the war machines, it does not do much for the average citizen and eventually will erode the quality of life for all nations, particularly the United States. TOTAL COST OF UKRAINE/ISRAELI WARS UP THOUGH 2023: The most recent data suggest that Ukraine will continue to focus its attacks on defensive positions

by wearing down Russian troop advancements in several key cities critical to key supply lines. Also, under relaxed rules from many countries, (including the U.S.) Ukraine and anti-Putin factions inside of Russia are increasingly attacking Russian assets and fuel depots, trains and even fighter jets inside of Russian borders. These attacks coupled with shortages, inflation, and falling Russian GDP, along with 600,000 Russian and foreign lives lost fighting for Russia, are wearing down the 2024 US ECONOMIC REPORT-MIDYEAR UPDATE WWW.BOTDORFRESEARCH.COM patience of Russian citizens. This has resulted in Putin himself evacuating the Russian Palace on more than one occasion pending riot arrests and the Putin police and the Russian Federation Security Forces increasing coverage to dispel larger and larger crowds. Putin’s problems are mounting on all fronts of the war and are starting to impact him domestically as violence increases inside of Russia. This war has now become inflationary for countries around the world. WHY THE FEDERAL RESERVE DOES NOT ACTUALLY DETERMINE INTEREST RATES BY THEMSELVES It is logical to assume that the Federal Reserve Board and the Board of Governors known collectively as the Federal Open Market Committee, controls the overall direction of interest rates. While this is true on some level, the Federal Reserve does not control global demand for U.S. debt. The global credit and debt markets decide demand for U.S. securities and thereby over time, impact how and when the Federal Reserve may act. Historically, demand for U.S. T-Bills and U.S. Bonds has been strong, but U.S. demand is not immune from international pricing pressure. As an example China has reduced its holdings in U.S. debt over the past ten years by liquidating over two trillion dollars of U.S. bonds, recently again a net seller of $53 billion in U.S. bonds. Japan is currently the largest foreign owner of U.S. bonds at just over $1.1 Trillion. We note several facts about the Federal Reserve below. “Nearly half of all US foreign-owned debt comes from five countries. All values are adjusted to 2023 dollars. As of January 2023, the five countries owning the most US debt are Japan ($1.1 trillion), China ($859 billion), the United Kingdom ($668 billion), Belgium ($331 billion), and Luxembourg ($318 billion)”. (usafacts.org, 2024). It is the Federal Reserve's actions, as a central bank, to achieve three goals specified by Congress: maximum employment, stable prices, and moderate long-term interest rates in the United States. (federalreserve.gov. 2024). “The FOMC consists of all seven members of the board of governors and the twelve regional Federal Reserve Bank presidents, though only five bank presidents vote at a time—the president of the New York Fed and four others who rotate through one-year voting terms.” (Wikipedia.org, 2024). Think of the International Bond Market as the Super Bowl of Bond Debt from countries around the world. The Federal Reserve Board represent the US referees on U.S. soil, they are not the players in the game. The players are the countries, companies, and individuals that buy and sell the bonds. While the referees can influence a short term outcome, in the long run, it is the buyers and sellers of the bonds who influence the outcome, and by association the price of U.S. debt and therefore the price of money in the United States. Given last year’s downgrade of US debt by the Fitch’s Bond Rating Agency, (see out earlier reports) and the ballooning U.S deficits, some countries are selling U.S. bonds and reducing their bond exposure to U.S. debt, especially the BRIC countries. It was not that long ago when China owned over $3T in U.S. debt, now down to $859B. Our deficits spooked them into dumping U.S. bonds into the global markets. In all fairness, they also needed the cash to shore up their real estate problems, which are substantial. (see our 2023 Report). 2024 US ECONOMIC REPORT-MIDYEAR UPDATE WWW.BOTDORFRESEARCH.COM Eventually if the deficit continues to spiral out of control, now up to $34.7 Trillion dollars, the U.S. will start to see stress in the bid to cover ratio, meaning less demand for U.S. bonds. As we have to compete with not only selling bonds every quarter to finance the deficit, but we also compete with sellers who already hold U.S. bonds, also selling at the same time. That means there could be more supply in the market at some point. If the holder of U.S. debt (U.S. bonds) wants to unload a large block of debt, they are free to set the price. The world markets can only absorb so much U.S. debt at a time and at some point foreign holders could elect to set prices below U.S. auction sale prices. To some extent, this means other countries could decide or have influence on the price of our debt. Although the U.S. bond market is the largest in the world, it is not a market without limits, particularly with record amounts of global debt needing to roll over. We spent considerable time discussing world debt in our 2022 and 2023 US Economic Reports and why global demand to finance debts is at unhealthy levels around the world with some countries now over 3 to 1 on their debt to GDP levels. The USA is now pulling past 1.20 to 1.00 and headed for much higher ratios in the years ahead. This is a perfect storm brewing on why the price of U.S. debt is likely to rise than fall in the future, meaning the Federal Reserve could be forced to increase interest rates because the global cost of capital is setting up to rise to keep the debts rolling over. Remember the Super Bowl analogy. There is not much the referees can do about the outcome if Patrick Mahomes throws six touchdown passes in the game. If demand weakens in the years ahead for US debt especially from financial engineering by BRICS, the U.S. could be forced to raise rates irregardless of how the U.S. economy is faring. The Federal Reserve will be powerless to cut rates in the face of the global debt Tsunami that is building and already at dangerous levels. This includes the amount of U.S. debt in the market. What is BRICS and its purpose? “BRICS refers to certain emerging market countries-- Brazil, Russia, India, China, South Africa, and more—that seek to establish deeper ties between member nations and cooperate on economic expansion, including trade. The countries function as a counterbalance to traditional Western influence.” (Investopedia.com). “While the renminbi will be the main currency for trade, payments, and settlements within BRICS, the role of a new prime holding currency offers fresh possibilities. Regarding trade, Saudi Arabia and the UAE will most likely trade with China in renminbi, independent of the denominator currency.” (omfif.org. Feb 29, 2024). What is BRICS trying to accomplish? 2024 US ECONOMIC REPORT-MIDYEAR UPDATE WWW.BOTDORFRESEARCH.COM BRICS countries aim to create new economic and trade systems separate from the U.S.-led Western systems, according to the group.Aug 21, 2023 “Over 40 countries, including Iran, Saudi Arabia, United Arab Emirates, Argentina, Algeria, Bolivia, Indonesia, Egypt, Ethiopia, Cuba, Democratic Republic of Congo, Comoros, Gabon, and Kazakhstan have expressed interest in joining the forum, according to 2023 summit chair South Africa.” (reuters.com Aug 21, 2023). If this trend continues, demand for U.S. debt as the “number one global currency” will cease to exist and the United States could be in danger of being just another currency. In fact it is baked into the stars at this point unless the U.S. radically reverses existing monetary and fiscal policies. The fallout from the dollar unwinding its status as the world’s currency will mean that the United States could lose its status as a Super Power nation over the next decade. Without other countries financing our debts, our cost of capital will soar driving interest rates in the U.S. to more than double from where they sit in June of 2024. A large part of the world is lining up to crash the U.S. dollar and we need to get serious about reducing our deficit to withstand what is coming. Many people rightfully think that the dollar is the strongest currency in the world. While it is currently the most traded, it is far from the strongest currency in the world for the reasons we have stated herein. Here are the top eight strongest currencies in the world and their respective exchange rates of the last week of May, 2024. 1-The Kuwaiti Dinar-$1.00 US equals .31 Dinar. 2-The Bahraini Dinar-$1.00 US Dollar equals .38 Dinar. 3-Omani rial-$1.00 US Dollar equals .38 Dinar. 4-Jordania Dollar- $1.00 US equals .71 Jordan Dollar. 5-Bristish Pound-$1.00 US equals ..78 British Pound. 6-Gilbraltar Pound-$1.00 US equals .78 British Pound. 7-Cayman Island Dollar-$1.00 US equals .83 Cayman Dollar. 8-Swiss Franc-$1.00 US equals .87 Swiss Franc. 2024 US ECONOMIC REPORT-MIDYEAR UPDATE WWW.BOTDORFRESEARCH.COM How and Why do Currencies Rise and Fall Against the Dollar? The rule is simple, on the world stage the strongest currency with the strongest balance sheet is what the world, companies and individuals want to own. It is why smart investors in the US have coveted the Swiss Franc for decades although that is starting to change. As we note from above, the Swiss Franc, a coveted currency for over 75 years, is now falling below many of the Mideastern countries on the most valuable currency scale. To provide a better understanding of what happens when currencies change value we will compare the U.S. dollar to the Kuwaiti Dunar. Kuwait has total debt of $14 Billion which is only 3.12% of their GDP. This stat comes from the US Federal reserve in St. Louis. “According to the World Bank, Kuwait's estimated gross national income (GNI) per capita in 2024 is $160.4 billion (nominal) and $264.3 billion (PPP). This makes Kuwait the fifth richest country in the world by GNI per capita.” (Wilipedia.org, 2024). “As of April 2024, the International Monetary Fund (IMF) estimated Kuwait's total government debt to be 3.12838% of GDP. This is down from 11.70408% of GDP in 2020. Trading Economics predicts that Kuwait's government debt to GDP will reach 4% by the end of 2024 and 6% in 2025.” https://fred.stlouisfed.org/series/KWTGGDGDPGDPPT. 2024. The US is on track for a GDP of 25.6 Trillion (we believe it will come in lower in 2024) and has total debt as of May, 2024 of $34.7 Trillion. Kuwait’s has (160/14) 11.42 times revenue against their total debt. The U.S. currently has (34.7/25.6) 1.35 times revenue against total debt. Which debt would you prefer to own? I know I would sleep better putting a billion dollars into a country that makes over eleven times the revenue to cover debt versus one that can barely gross over one times. The irony of this problem for the U.S. is if we just opened up our drilling for oil and gas (some of the largest reserves on the world) we could vastly increased our own GDP, dramatically cut our need to import oil at much higher costs, and we could slow the need to borrow money to cover our operating cost. Instead we are watching our dollar fall each year, while the Mideast gains purchasing power against our dollar. The reason Kuwait’s PPP (Purchasing Power Parity) is over $263 Billion a year, is because when they buy something on the world stage against other currencies they convert at such high exchange rates against other currencies, they get a discount of (160/263) 64%, adding $103 Billion in purchasing power. Can you imagine spending $100B but only having to pay $36 Billion? This why our country is in trouble. When a weak currency buys something against a strong currency, they always pay a premium to make the deal. The Kuwaiti Dinar (KWD) is now the strongest currency in the world due to their oil reserves. Frankly, they are not worried about the decline of fossil fuels and future demand and neither are US energy companies that produce fossil fuels. If EV production increases from here the U.S. will need to vastly increase its imports and production of fossil fuels to supply the electricity needed to power more EV’s. 2024 US ECONOMIC REPORT-MIDYEAR UPDATE WWW.BOTDORFRESEARCH.COM “In 2023, about 4,178 billion kilowatt-hours (kWh) (or about 4.18 trillion kWh) of electricity were generated at utility-scale electricity generation facilities in the United States. About 60% of this electricity generation was from fossil fuels—coal, natural gas, petroleum, and other gases”. (U.S. Energy Information Administration, EIA, www.eia.gov. 2024). We saw Japanese electric rates vastly increase after their nuclear accident on March 11, 2011. We note the incident as reported by the Scientific Committee on the Effects of Radiation. “The Fukushima Daiichi nuclear power plant in Japan experienced an accident on March 11, 2011, caused by the Great Tohoku earthquake and tsunami. The accident is the second worst in nuclear power history, after the Chernobyl disaster.” (www.unscear.org.2011). Japan was immediately forced to dramatically increase utility rates which began to rival rental and mortgage payments shortly after the incident. They also had to replace nuclear power with fossil fuels from Australia and Russia. “After the Fukushima Daiichi nuclear power plant meltdown in 2011, Japan's electricity prices increased due to higher fossil fuel costs from increased imports. The country's electricity generation shifted to fossil fuels, with older oil-fired plants increasing their generation from 10% in 2010 to 14% and natural gas increasing to 35% of the power mix in 2011. Japan now generates 60% of its power from coal and liquid natural gas imported from Australia, Malaysia, and Russia.” (Google, 2024). If current policies on U.S. drilling and coal production remain in place we will need to increase our fossil fuel purchases from Venezuela, China, Russia, and the Mideast, further putting pressure on the dollar and supporting regimes plotting to ruin our country and our currency. (See our current and past reports for more details). Under any circumstances by enriching communist regimes and buying fossil fuels overseas we are creating inflation in the U.S. be keeping energy prices to high. We are also creating more pollution to import these fuels and in the process actually increasing global carbon emissions. Transporting oil to our shores from large Diesel Oil Tankers and from countries using far less efficient drilling practices to pull the oil out of the ground is more taxing on the environment than if we just pulled it out of the ground domestically. The world will use over 101 million barrels of oil per day in 2024, regardless of what country produces it. Oil consumption is a zero sum game when calculating the global pollution emissions released into the atmosphere. The only thing that changes from the U.S. shutting down production of oil and gas is the price. We pay a hug premium on what it cost to fill our tanks so we can pretend we are saving the planet. The 2024 RACE TO THE WHITE HOUSE-WHY BIDEN MAY HAVE TO RESIGN AFTER THE ELECTION The United States economy is facing a future with a devalued dollar, projected negative real growth in the U.S., rising rates (again) likely sometime in 2026 and 2027, an extended frozen housing market out of equilibrium, over regulation to the tune of $1.7T in the last three years levied onto businesses, and a stock market that is stalled outside of the “Elite Eight”-(See our 2024 Report). Small caps are struggling to get financing and soaring deficits are not going to help them or the U.S consumer already struggling with well over One Trillion in consumer debt for the first time ever. 2024 US ECONOMIC REPORT-MIDYEAR UPDATE WWW.BOTDORFRESEARCH.COM Technically speaking we have had two consecutive down quarters of GDP at 3.40% revised in Q4 of 2023 and a huge downdraft of 1.60% revised for Q1 of 2024. This compares to 4.9% from Q3 of 2023. We can stop using the term healthy economy, goldilocks economy, and the pending soft landing that may occur. We are now in route to using fasten your seatbelt, put your heads down and your seat in the upright position. The Press as usual is well behind what is setting up with the U.S. dollar and will be throughout the election. When was the last time you heard someone mention that the BRIC transition is well underway and will be one of the main reasons interest rates will have to rise in the longer term? The financial media will not figure this out for the pending election but might be focused on this topic for the 2028 election when the carnage becomes more widespread. As to the election we have studied the pending rumor mill, and made some well-placed phone inquiries, and are now predicting what we feel is going to be an outcome. Unfortunately, the Biden/Trump feud is going to get worse. The House Oversight Committee is nearing a two year investigation of what really happened with Biden and his family. They now have over three million emails, texts, documents and sworn testimonies that confirm over $24M was wired into accounts controlled by the Biden family as confirmed by James Comer, Chairperson of the 2024 House Oversight Committee. No one that testified seems to know what the money was for, even the family members who got the money. Does this make sense? He recently confirmed these numbers in an interview with Maria Bartiromo on Fox News. Whether or not the Biden base wants to believe there is no evidence does not matter at this point. This issue is about to haunt Biden forever. Mr. Comer described the wall of evidence as “Possibly the worst public corruption scandal in U.S. history.” There is only one tangible way out for Biden at this point and that is to seek a Presidential pardon for all of his “alleged crimes.” This will not come from Trump if he wins. The House Oversight Committee will present one of longest and most in depth reports ever created for Congress against a sitting U.S. President sometime this summer. While this report may not change many Biden voters, it will have an impact on the election results as some democratic voters either change sides or just refuse to vote at all. Some Trump voters may do the same given his legal issues. That said, both candidates will continue the fight. Who do we know that might enjoy becoming President if only for three months? We believe if Biden fails to notch up significantly in the polls after the debates, (which may not even occur)his only way out given his legal issues may be to resign and wait for the inevitable Presidential pardon that will come from Kamala Harris as President from September of 2024 to January of 2025. If Biden should retake the White House, he will be able to kick this problem down the road and deal with it later. If Trump should win in November, we put the odds of Biden resigning in December as President at about 90%. While we prefer to stay away from political issues, given the issues we have raised in this report, our 2025 U.S. Economic Report is entirely dependent on who wins the white house in November. As to rumors that Gavin Newsome or Michelle Obama will be the new Democratic Nominee at the DNC convention, it is possible, but we see both as long shots to win the election. Gavin’s 2024 US ECONOMIC REPORT-MIDYEAR UPDATE WWW.BOTDORFRESEARCH.COM recent fascination and visits with world leaders is fueling speculation he will be penciled in at the at the upcoming DNC convention. We are not sure given his state’s $68B deficit and his relative lack of experience, that he will have the goods to win over voters in 2024. He looks more like a 2028 candidate to us, but his nomination if he can clear the legal issues, would not surprise us. The formal “odds” of Newsome winning the White House in November are 3.9%. As Newsome might put it, “So you saying I have chance”? YES, IT REALLY IS THE ECONOMY-STUPID. One of our biggest challenges putting out the 2024 Report was we had to make our forecast in November of 2023 for our December release. We had just got the Q3 GDP report showing the economy posted a record high number of 4.9% for Q3 of 2023. Meanwhile, our pending Q4, 2023 and future predictions for 2024 was for negative growth in real terms for 2024 GDP. Were we wrong? I thought about what am I missing as we were releasing last year’s report? Did we need to reevaluate our thesis? Biden never looked so smart after that the Q3-2023 report came out. Eventually I made the call to go with our original forecast and cited in the report that the Q3 GDP was an “anomaly”, it was not going to stick and in fact, GDP is going to get worse, a lot worse. Then came the numbers, Q4 of 2023 came in at 3.4%, down sharply from Q3, and Q1 of 2024 came in at a paltry 1.6%. It took time for the reasons we cited to see the trend fully develop. We expect that Q2 GDP will beat Q1 1.6%, technically pulling the US out of a recession. In reality, our headwinds are likely to put us right back into one. We often get so far ahead of the curve, we might look a bit off in the short term, like right now without significant changes in U.S. fiscal and border policies, why the dollar is destined to devalue from here and why housing prices are in the process of a pending steep decline. Last year’s 15.9% overall decline nationwide, and the recent April housing decline of 6.6% that just came in from Redfin, our 2024 housing forecast is on the mark. These markets will see declines albeit many high end luxury markets and gated communities will see smaller declines when they do come. Given the root causes of what is happening with interest rates and the historical gap with median income versus median housing prices at all-time highs, the trend is already in motion and has now hit the home builders. Either wage earners need a significant rise in incomes of at least 25% from here or housing prices need to fall. One or the other is inevitable. THE U.S. ECONOMY FOR THE SECOND HALF OF 2024-REPORT CONCLUSIONS. Most commentators and analysts use as a practical definition of a recession, two consecutive quarters of decline in a country's real (inflation-adjusted) gross domestic product (GDP)—the value of all goods and services a country produces. (www.imf.org. 2023). Well, according to the traditional definition of a recession, which started in Q2 of this year we already met the classical definition of being in a recession. In fact the GDP growth was so low in Q1 of this year, it is possible for Q2 of 2024 to slightly beat the 1.6% figure, meaning we will by technical terms, be out of a recession. We do not think it matters much at all weather Q2 beats the Q1 1.6% number. Over the course of this year, we maintain our forecast of a breakeven to slightly negative real growth for the U.S. economy, which means even stretching the technical definition of a recession, the U.S. economy is headed for trouble given all of the issues we have highlighted in this report. 2024 US ECONOMIC REPORT-MIDYEAR UPDATE WWW.BOTDORFRESEARCH.COM Many economist and technical analyst that watch M2, debt to GDP, and deficit growth have stated these indicators are outdated and by themselves do not mean much. They have a point; however, we prefer to expand our analysis and include the Inverted Yield curve, the housing markets, consumer confidence sentiment, business investment, core inflation along with food and gas, defense spending, real wage growth or lack thereof, and exploding Social Security, Medicare and Medicaid cost. This year we can add another $500 Billion to pay for immigration. When factoring all of the real cost absorbed by the U.S. Government, and by looking at them together, we feel we can draw a fairly good picture of where things are headed. Yes, the M2 money supply is also currently shrinking the most since the Great Depression. The M2 money supply includes coins, physical currency, retail money market funds, and small time deposits. “From April 2022 to May 2023, the M2 fell by 5.5%, which may also end up close to the rate of inflation when the final numbers come in, if you include gas, insurance cost and food, something we think matters a lot to the American public. This is the first time the U.S. money supply has shrunk since 1949 at this level, and is due to a number of factors, including: Rising interest rates, the Fed reducing its balance sheet holdings by around $800 billion, and Changes in Fed policy.” (Ycharts.com). What happens if M2 continues to fall? "For a fractional reserve, debt-driven economy, declines in M2 are akin to economic starvation." Declines in M2, as the US is seeing now, have been correlated with economic depressions and panics, Anastasiou said.” (spglobal.com. May 31, 2023). We note from Larry Kudlow on Fox news the cost of regulation over the past three Presidents, Obama, Trump, and Biden. Kudlow reported the following numbers on his show on 5-21-24. The cost of new business regulations were as follows for companies in the United States, The Obama Administration added $303 Billion, Trump cut out $163 Billion, and Biden has now added a whopping $1.6 Trillion in new business regulations. This is all coming on the heals of higher inflation, higher taxes on the way, and what will be the staggering cost of paying for 10M immigrants in the United States. The real victim of the cost of living rising so high is the consumer. There is very little left on the tank for consumers to keep spending at the current rates. We already spend $1.7 Trillion more that we take in revenue in the U.S. Total revenue for 2023 was $4.5T while we spent $6.2T. According to the House Committee on Homeland Security, it is estimated the medical, education, housing, food, training, and shelter cost to support immigration will cost tax payers over $450 billion per year added to the deficit. In other words we are going to spend just over 10% percent of all of the revenue collected by the U.S. government to pay for immigration and that figure will keep rising as long as the border remains open. 2024 US ECONOMIC REPORT-MIDYEAR UPDATE WWW.BOTDORFRESEARCH.COM We actually put the cost at a higher figure when crime, transportation, translators cost for schools and for processing immigrant paperwork from over thirty-five countries, and counseling cost are added into the calculation. Most Americans believe in responsible immigration to allow others to pursue the American dream. I am also willing to bet that 90% of American have no idea how expensive a wide open border policy is and the burden it will cost tax payers for generations. “The federal government collected $4.5 trillion in revenue in fiscal year 2023 (FY 2023). The federal government spent almost $6.2 trillion in FY 2023, including funds distributed to states. Federal revenue decreased 15.5% in FY 2023 but remained almost 8% higher than in FY 2019.” (usafacts.org. State of the Union, 2024).” “The spending “could cost as much as an astounding $451 billion,” per year, the report stated, citing research from the Center for Immigration Studies in May 2023. “The population of the United States is roughly 330 million, plus perhaps 15 million illegal migrants. Nov 16, 2023.” (homeland.house.gov. 2023). Let us Do the Math. So we haul in $4.5 Trillion in Revenue and we spend $5.1 Trillion before actual operating expenses the government needs for millions of programs not listed below that we use to run the country. 1-We need $1.4 Trillion just for interest on the national debt. This number will rise because the cost of capital is rising, something Congress should pay attention too. 2-We spend $900 Billion on Defense. 3-We need $1.3 Trillion for Social Security. 4-In 2024 Medicare will cost just under One Trillion Dollars. 5-We now spend $500 Billion each year to support Immigration. So without factoring in the millions of line item expenses needed to run the country, we spend $5.1 Trillion per year and are around $600 billion in the hole before we spend one dime to actually run the government and fund all of the other social, infrastructure, clean energy, water, education, and other local projects we need to replace, repair, and maintain our infrastructure. Last year we needed to borrow another $1.7 Trillion just to get by and pay the bills. It is time for Americans to start voting with their wallets and forget about ideologies for a while. 2024 US ECONOMIC REPORT-MIDYEAR UPDATE WWW.BOTDORFRESEARCH.COM A bankrupt country is not a country with a bright future. This is fundamentally why the current 7% mortgage rates will seem like a bargain compared to what just might be coming over the next two to three years. If rates hit 10%, people will be saying remember when mortgage rates were 7%? One or two small quarter point rate reductions, if they come at all, will be just like the refs calling back one of Mahomes six touchdown passes. In the long run it will not make any difference in the outcome. It is about what will follow into 2026 and 2027 that matters. What follows will be 100% dependent on the U.S. fiscal policy in 2025. Afterall, the numbers do not lie. They are not the result of any one President; they are not at this level because of just Democrats or just Republicans. They do not have a political bias. They are here at current levels because we as a people have acted like fiscal prudence does not matter. This is the time to remember the late great President, John F Kennedy. “Ask not what your country can do for you, ask what you can do for our country.” It is time for all U.S. politicians to put the country first and their own fiscal interests behind the needs of the country and focus on the math. Our window to turn our problems around is at the tipping point and if not addressed next year, will impact the quality of life in the U.S. for a generation or longer. Signing Off, John C. Botdorf BOTDORFRESEARCH.COM

0 Comments

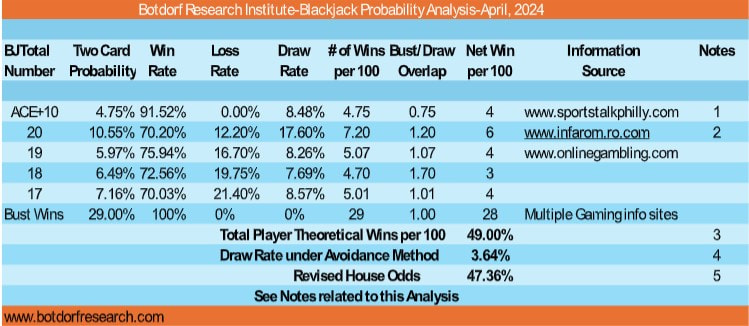

THE GAME OF BLACKJACK IS IT POSSIBLE TO GAME THE SYSTEM to win at blackjack? Most of our readers know we like to research and write about complex topics like Black Hole Theory, Artificial Intelligence, and subjects like valuation modeling and whether or not Aliens exist on earth. Every now and then it is time for a discussion on something relatively simple just to have some fun. Of course, we involve the same level of intensity and research even if the subject matter is easier to explain. For our blog this month, we chose to discuss the game of Blackjack and whether one can one win consistently in this game of chance, or any game of chance for that matter? As a matter of disclosure, I have personally developed, tested, and tweaked the “Avoidance Method” I will disclose in this article and can confirm it works about 85% to 90% of the time over two or more sessions of blackjack. To be clear there is no such thing as a method that will consistently outperform the house odds on any table game. Then again, a player need not win over 50% of the hands played to win money. They just need to win more hands than the Dealer during any given session of play assuming they bet the same amount on every hand. A Blackjack session is described as playing the game for a period of at least 60 to 90 minutes, suffice to accommodate at least 100 hands of blackjack depending on how many players are at the table. Some interesting points about the game. Blackjack is like every other game of chance in any casino in the world, the odds of winning actually generally do go down the longer one plays. However, we have looked at a mathematical model that may rival this reality. We are going to teach you a method the House will never mention as it narrows the gap on the regular 7% advantage the House maintains under normal conditions. Blackjack is also the only card game where if you and the dealer lose (you each bust over 21) the Dealer still gets paid on some other hands, particularly with four or five players at the table. Think about the three people or so who busted before the Dealer busted. They lose, and yet the House wins their money even though the Dealer eventually busted, at least on those people who busted first. The remaining players who did not bust would win in this case if they just stayed in the game with any two cards. In essence the Dealer has two bites of the hand to beat each player. I don’t prefer this “double jeopardy” which is why I don’t play by their rules. The whole concept behind Blackjack is built on one single principle; the requirement that the player bust first. Get rid of the double bust principle and now we have a real shoot out. This is exactly what happens with every other card game involving the house where time will eventually work against the player as the house odds will eventually win over an extended period of time. The house will win because gambling in any casino is based on statistics that favor the house. Although gamblers can and do win on short runs, there is no such thing as a mathematical model that will inure to the benefit of a player over the long run. Or is there? Botdorf Research Institute Blackjack Post-April-2024www.botdorfresearch.com The longer one plays under the “Avoidance Method”, the more likely the statistics behind this strategy will deviate toward the mean, meaning the odds actually produce odds similar to what the House enjoys, about a 49% win rate. We are going to flip that advantage to the player under our thesis that is supported by credible data. Remember one does not need to win over 50% of the hands dealt during any given session to win because a draw cancels the game with no one winning or losing. Is it then possible for a player to have odds very close or better than the House? Well, that is the point of this whitepaper. How is this possible? We shall discuss the strategy of how and why this method works in just a minute. The real value behind this article is not about winning a few bucks in a game of chance. It is really about why it is important to elevate your thinking when faced with how such a possibility can exist in the first place. How is it that a game that makes Las Vegas well over one billion dollars a year (in just Blackjack) can be tweaked to allow the player to have a near equal advantage or superior one? Under the so called “rules of blackjack”, the house maintains a 7% advantage over the player over the long run. This is because of the way the game is played by 99% of the population. Therefore most people would agree there can be no greater challenge than trying to win money from a billion dollar industry that built Las Vegas. That said, the real exercise in this article is about thinking outside the box, and by looking at what is wrong with this picture? Before we reveal how to flip the game of blackjack toward your favor, let us review how much money is bet on blackjack and how often does the average player win under the traditional rules of blackjack, i.e. hit on cards at 16 or below in most cases and rest on 17 or above. According to Sportstalkphily.com, (and multiple other sites) the odds for a player winning a game of blackjack are as high as 42.22%. This leaves the house winning 49.1% of the time, with the third possibility of a draw being 8.48%. (www.sportstalkphilly.com. Apr 2, 2024). Similar sources report numbers that are very close to these figures. Deviations can and do occur due to a wide variety of assumptions, including over 100 variations of Blackjack that exist around the world that use different rules. What is not revealed is the amount of time playing blackjack but it really does not make any difference as far as the house is concerned how long any one player engages in playing the game. Your Pit Boss may care because he or she has to log your time of play. It does make a difference when looking at the game from the inside out. Think about it. If one were to gain a slight statistical advantage playing blackjack against what the house “teaches” than this slight advantage might increase you chance of playing longer and leaving the table with a net win. While any player advantage may be limited to just a few certain card profiles, if one can draw to a breakeven while playing under a different model, then is it possible to make all of your profits on the few hands that better favor a player outcome? We provide the table for this new model in our conclusions. Botdorf Research Institute Blackjack Post-April-2024www.botdorfresearch.com As a drag along benefit most Casinos grant “perks” depending on two factors. How many hours a day does a player sit at the table and what is their average bet per hand. This information is very stealthy reported to the pit boss at the larger tables ($50 per hand or above), and that creates the “level of play” which in turn may grant a player free rooms, free meals, and even airfare, show tickets and airline reimbursements, depending on your gambling score. The House does not care whether you win or lose over any particular period of time. They know the odds will eventually get your money; hence they want to encourage you to play longer and bet more over time. In essence, some players might not care whether they win or lose if they can gain thousands of dollars in “perks” and can leave the tables on a breakeven. That is why I choose the Avoidance Method of play because I am not there to win, I am there not to lose. Frankly, I do not play much anymore because I don’t need free suites anymore. I own time shares with up to three bedrooms on the strip that cost me far less than a hotel suite and come with kitchens, knock out views and multiple Large Screen Television Screens. Selfish Plug (See “Mastering Your Timeshare” on web site). I go to Vegas now to see the shows, go to the gym, then the Spa’s, work, and go to great dinners and restaurants. I do not spend much, if any time anymore, playing blackjack because I prefer doing other things. Another Selfish Plug- See “Mastering Your Diva” on web site. That said, a few decades ago, I played at least five hours a day with $50 to $100 a hand average bet so I could get perks that on some trips were worth thousands of dollars. Of course, there were a few trips when losing a few thousand was the end result. Although I won most of the time if you count the perks, I decided to refine a system that was not based on trying to win but rather was focused on trying not to lose. I rationalized the free perks, provided a much better “net win” than playing the way the “House” wanted me to play. When I focused on a different strategy I rarely lost much money, nor won much, but the perks really were free. Perks worth thousands in free dinners, show tickets, spa upgrades, and first class airfare and hotel suites picked up by the Casino. The problem was it took almost half of my time playing blackjack to earn my free perks. I finally reached the point where even the free perks were not worth it for me. I wrote this white paper for the younger crowd who like I did, enjoy the challenge of beating the house, looking less stupid in front of your soulmate on how you gamble, and having the mindset and money to blow $1000 bucks on dinner and show tickets. As most of us know, free perks by a Casino are not normally free at all. They are usually kind of like your spouse telling you they saved you thousands of dollars at the after Christmas sale while your next credit card statement confirmed you spent thousands of dollars so you could save one thousand. Botdorf Research Institute Blackjack Post-April-2024www.botdorfresearch.com A player may play three or four times a day, meaning the combined time of play could equal about five or six hours of play. The point here is that a player may win on one session, draw to a tie on a second session, and have one or two losing sessions, all in the same day. At the end of the day the only real statistic that matters to most players, is did they end the day up or down, with or without perks. How much does las Vegas make on gambling/blackjack According to Forbes.com, Las Vegas had gambling revenue of $8.28 billion in 2022, up 17% from year ending 2021 which saw $7.96 billion in gambling revenue for 2021. Everything you see in the above picture was built on gambling revenue with up to 29% of it coming from the game of Blackjack. We present from Forbes the breakdown on table gaming and how profitable card games are for casinos. Sports Books generated $446.7 million in revenue on $8.7 billion in wagers. Revenue and wagers in 2022 broke the previous year’s record of $445.1 million in revenue derived from $8.1 billion in wagers. Baccarat surged last year with $1.18 billion in revenue, a massive 25.4% increase over 2021. Blackjack brought in $1.29 billion, a 14.4% increase over 2021, craps hit $447.2 million, a 9.7% increase, and roulette made $456 million, an all-time record for the game. (www.forbes.com. 2023). Is there something Wrong with the blackjack Picture? Botdorf Research Institute Blackjack Post-April-2024www.botdorfresearch.com So we know that in 2022, the casinos in just Las Vegas made $1.29 Billion in profits on Blackjack (the most of any game) as their portion of the $8.7B that was gambled during the entire year. Now, there are two things one should question before even ascertaining what the best way is to “game” the system to win more often playing Blackjack in Las Vegas. These two statements are key to understanding how to rival the old method of playing Blackjack. 1) Is it smart to take advice on “how to play blackjack” from the same source that makes over a billion dollars a year on the very game they are advising you how to play? 2) Why the odds of hitting against a Dealer on any given scenario do not matter 99% of the time. Remember, it makes no difference if you might hit a 13 against a dealer showing a 10 on top under what we are about to reveal. The only thing that matters here is what is the Dealer forced to do under the same circumstances. In this case the Dealer must hit a 13 regardless of what you are showing as your card on the table or what you have in the hole, whether it may be a ten or a two on top or in the hole. It is absolutely irrelevant when reverse engineering the game of Blackjack. If you have ever played the game of blackjack, you will often hear a player ask either the Dealer or another player say something like this, “Is it right to hit a 16 when the Dealer is showing a 10 on the table?” Most if not all of the time, Blackjack players will answer or wish the last person to hit before the Dealer showing a 6 on top, should just stand and let “the Dealer bust”. In fact if the person with a 16 does hit and gets a 10, the result from the table is usually one of huge frustration and disappointment, essentially blaming the person on third base for the loss of all of the players remaining in the game on that hand. The reverse is also true, if the Dealer is showing a 10 on top and you have 16, the advice from the “Casino” is to always hit because it is assumed the Dealer will have a 20. It may be assumed but it is mathematically more likely a Dealer will not have a 20, and has a better chance of busting that you pulling a 5, the only card you can win with if the Dealer supposedly is sitting on a 20. Either way your chances of winning in this case are slim but given a 62% bust rate with a 16, I will take the risk of the Dealer not having 17-20 and busting. Either way, it is essentially a lost hand in most cases. Why understanding different math may prove the key to increasing blackjack wins Botdorf Research Institute Blackjack Post-April-2024www.botdorfresearch.com Most people if they visit Las Vegas enough will be offered a chance to “learn” how to play Blackjack with a lesson from the Casino. These lessons are usually offered on Saturday mornings or other slow times, where the casino will “help” you to understand how to play games of chance. This is like being thrown into a cage with a Gorilla and watching the Zoo Keeper throw a pile of bananas into the Cage and then trying to have a conversation with a Gorilla on how to split the bounty fairly. Let us put this into perspective, If you made $1.3 Billion a year on blackjack, would you be unbiased in how to teach the game? There are a number of books on gambling with many blackjack “how to play” strategies based on this or that statistic. You can determine how many “tens” are left in the Deck by counting cards, when to split cards, and whether a player should hit with a twelve (10 and 2) when the Dealer is showing a ten or a face card on top. None of it really matters when one converts their thinking about how blackjack really works. The whole game of Blackjack is a partial misdirect. It is not about what number or what odds are dictating whether one should hit or not hit at all. The real science behind Blackjack is the key to increase your odds of winning by defusing your risk profile. The real math behind Blackjack has to do with the overall odds of busting. To understand the one move that matters in Blackjack and rules supreme over all others, one must understand what the overall odds of busting on a single hand of Blackjack are and why ignoring this risk profile may have a razor thin likelihood to increase your overall wins. Our approach simply avoids the risk of ever busting and transfers this risk to the dealer. It does not matter what the odds are on any given hand or scenario because we are not taking any “Bust” risks. “As for overall bust rate, in a common six-deck game, dealers bust about 29 percent of the time if they stand on all 17s, and just under 30 percent if they hit soft 17.” (Tunica, 2017). These are 29 juicy hands we are going to take without every risking a dime out of every 100 hands we play. This data comes from the casino industry and even using different sources and different House rules, the data seems to cluster within 1% of 29% as to the percentage of times a Dealer will bust on Blackjack. We will also employ some other strategies designed to improve the player odds of winning more hands. “The main reason why dealers win more often than players is this: the dealer has an edge because of the so called “double bust” rule in blackjack. Whether you are a new player or a seasoned blackjack pro, you will always act first. If the total value of your cards exceeds 21, you automatically lose.” (Blackjackreview.com. Aug 21, 2022). “One of the biggest myths is to always assume that the dealer always has a 10 in the hole. That’s only true around 30% of the time (16 tens per 52 card deck). Here is a fact about Dealer hands. According to the math provided by Blackjack Age the dealer busts more than 28% percent of the time.” (edgevegas.com. 2012). Botdorf Research Institute Blackjack Post-April-2024www.botdorfresearch.com Probabilities of blackjack and the impact of using the bust avoidance method versus the “house” taught method Probability of obtaining a blackjack from the first two cards is P = 32/663 = 4.82654% in the case of a 1-deck game and P = 64/1339= 4.77968% in the case of a 2-Deck game. (Probability Theory Guide, 2022). According to the Gambling Gods, you and I should see 4-5 Blackjacks per 100 hands played. Note: For some reason this seems to work better for the Dealer? Part of our thesis involves understanding what Dealer outcomes we can count on to provide a 100% percent win probability. There is only one outcome that gives us this win other than the Dealer busting win. It is all about getting a Blackjack. How many of times can we estimate we will see a blackjack from the Dealer. Expect 3-4 Blackjacks per 100 hands. We will then add this figure to our 29 Bust wins and then examine other outcomes to add to our total wins under the Avoidance Method per 100 hands played. Note: In our Avoidance Method when playing Blackjack, it is statistically likely you could get a blackjack tie along with the Dealer. While the odds of this happening before cards are dealt are 1 in 461, they skyrocket to 28.68% if you draw a Blackjack and the Dealer draws a ten on top or an Ace on top. We will gladly take even money versus losing our win. Note: there are slight statistical variations on this figure depending on the number of Decks used in play but they are statistically not a big deal, like 10.55 versus 10.58. Most Casinos will offer you even money before showing their hand if they have a ten up. We advise to take the even money and avoid the risk of tying the Dealer and forfeiting your win money. Doubling your money on a risk free option is important in the overall Avoiding Bust Method strategy. We will add the four or five wins to the 29 Bust hands and now look at what happens with continuing our strategy. What is the probability of getting a blackjack on any particular hand? “The probability of being dealt two cards that total 21 (i.e., a 'natural blackjack') from a shuffled deck of 52 cards is calculated as follows. Adding the previous results gives the probability of a blackjack: p = 0.024133 + 0.024133 = 0.048266, or once in every 20.72 hands. (Quora.com. Oct 10 th , 2019).” “What is the Probability of getting Blackjack”? “But players win with 20 a lot more often than they lose, with about 70.2 percent of player 20s winning, 12.2 percent losing and 17.6 percent pushing. Twenty is a profitable hand for players against every dealer face up card. (Tunicatravel.com. 11-2-2016). PS: The draw rate is so high because of so many tens in the Decks. Remember, just calculating the odds of being a dealt a 20 with just two cards does not mean you will win. It just means you have a better chance. We present the figures below for the number 20. We will use 19, 18, and 17 in our model to reasonably ascertain what the odds are of winning with the “Avoidance Method”. We will first dispel the theory that there is a bid difference on playing with a single Deck versus a four or six Deck shoot. Frankly a single deck Botdorf Research Institute Blackjack Post-April-2024www.botdorfresearch.com can produce slightly better odds, the difference between four or six decks is statistically irrelevant. Here is the math. Mathematical Analysis Using Four Decks Hard 20 (drawn from among 64 ten-point cards)” 64*63=4032 possible variations. Soft 20 (drawn from among 16 aces and 16 nines): 32*16=512 possible variations. Any Hand (drawn from among 208 total cards): 208*207=43056 possible outcomes. Probability of any 20: (4032+512)/43056=284/2691 (within one standard deviation)=10.5537% Mathematical Analysis Using Six Decks Hard 20 (drawn from among 96 ten-point cards): 96*95=9120 possible variations. Soft 20(drawn from among 24 aces and 24 nines): 48*24=1152 possible variations. Any Hand (drawn from among 312 total cards): 312*311=97032 possible variations. Probability of any 20:(9120+1152)/43045=428/4043 (within one standard deviation) =10.5862%. We provide this math for those of you who may be traveling with the “Gambling Expert” hell bent on having you waste time going all over town looking for a casino with the fewest decks, suggesting this act will provide you a “huge” advantage affording you the opportunity to fill your suitcase with cash because the “Casino” just does not get the math. LEFT INTENTIONALLY BLANK the blackjack avoidance method-what do the numbers say? (1) Like any theory about gambling models, the output is only as good as the input. Our first note is